Posts by Admin

What is the best way to finance a second home?

Buying a second home – whether it’s a vacation home or purchasing one for investment purposes – is going to be a little bit different than when you purchased your primary residence. There are a few ways you can go about financing this purchase, if you need to. One of the ways you can do…

Read More6 Reverse Mortgage Pitfalls to Avoid

When you need some extra income during your retirement, you may have thought about getting a reverse mortgage to help with the cash flow. And while reverse mortgages do have the potential to help make your retirement financially more comfortable, there are some pitfalls you need to be aware of. Here are six pitfalls to…

Read MoreIs a Reverse Mortgage Right for You?

May retirees are living with the reality that they just haven’t saved up enough money to live the lifestyle that they would like to live in their later years. Perhaps they wish they could travel more or finally buy that red convertible that they’ve dreamed of owning since they were a kid, but between inflation…

Read MoreWhy you should hire a mortgage broker to get a Home Equity Loan

Getting a home equity loan (sometimes referred to as a second mortgage) can be a great way to access some of your home’s value that has been accumulating over the years as property values have gone up and as you have been paying down your mortgage. Home equity loans allow you to borrow large sums…

Read MoreWhen is the best time to refinance your mortgage?

Refinancing your mortgage can help pay off some debts at a lower interest rate or even give you some cash in hand to help you renovate your home. The downside of refinancing means that you are going to be adding to the balance of the mortgage you’re borrowing, which can be daunting – especially with…

Read MoreMost Common Mortgage Challenges for New Immigrants to Canada

When you immigrate to Canada, you will eventually want to purchase a home for yourself and your family. Not only is a home a safe, welcoming place, but buying a home is a great investment to make for your future in Canada. If you are a new immigrant to Canada, here are some of the…

Read More7 Tips to Getting Approved for a Mortgage: A Sure Loan for You

People however find this first step difficult. If you are looking to apply for a mortgage in the near future, here are 7 tips that can help you to get approved more easily. Check your credit score The better your credit score, the easier it will be for you to get approved for a mortgage.…

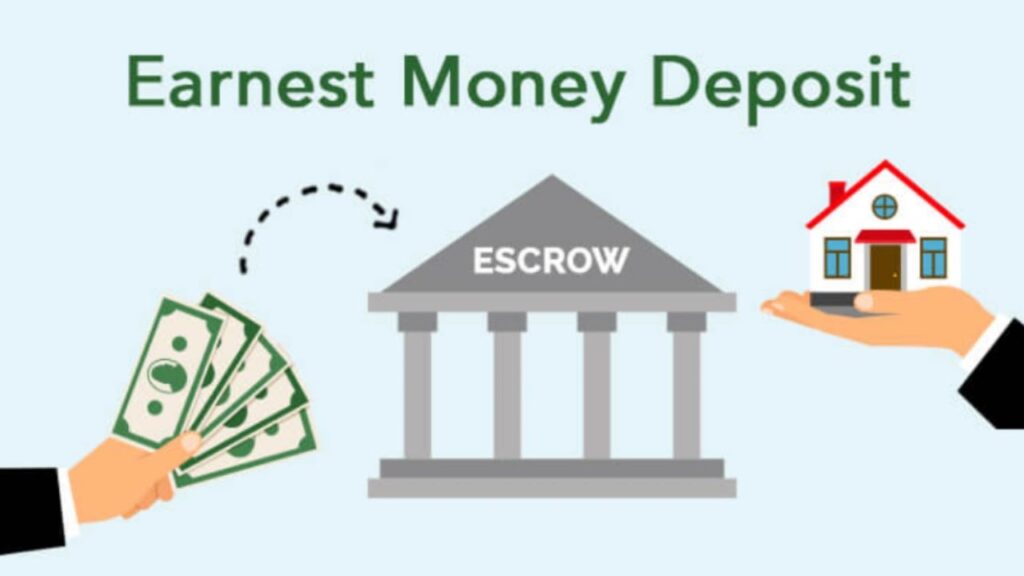

Read MoreWhat Is Earnest Money Deposit

When you find that dream home and want to show your serious intent to buy, you may come across the term, Earnest Money. It is similar to a security deposit that shows you are serious about buying the home. Sure Loan can guide you and explain things to you. Let’s take a closer look at…

Read MoreUnlocking the Potential: Your Guide to Second Mortgages

When you hear the following term, Second Mortgage, you may wonder why anyone would want a second mortgage. There are many reasons to get a second mortgage, and places like Sure Loan are here to answer questions and are here to facilitate the process. Not sure if Second Mortgages are for you? Let’s take a…

Read MoreTips For The Self Employed To Avail Home Equity Loan

When you are self-employed, getting a loan can seem like a struggle. However, it does not have to be though, and you can get a home equity loan whether you are self-employed or not. What is a Home Equity Loan? When you get a home equity loan, you take your home equity to use as…

Read More