Private Mortgage

Private Mortgage Lending: Exploring a Non-Traditional Path to Homeownership

When it comes to securing a home loan, most people immediately think of traditional banks or mortgage lenders. However, there has been a growing trend toward alternative financing options, such as private mortgage lending, in recent years. This non-traditional approach to homeownership has gained traction due to its flexibility, personalized terms, and ability to cater…

Read MoreMaximizing the Benefits: Creative Ways to Use a Home Equity Loan in Ontario

When it comes to unlocking the potential of your home’s equity, a home equity loan can provide you with the financial flexibility you need. In Ontario, Sure Loan For You is a leading provider of home equity loans, offering homeowners a range of options to maximize the benefits of their property’s value. Let us explore…

Read MoreExploring the Advantages of Private Mortgages for Borrowers

Private mortgages have become a flexible and viable financing option for borrowers who may face challenges when seeking traditional loans. Whether you have a low credit score, are self-employed, or require a quick approval process, private mortgages can provide numerous advantages. This article will explore the benefits of private mortgages for borrowers, highlighting how these…

Read MorePrivate lending – What you need to know before borrowsing money

What is Private Lending Private lending is a financial transaction between individuals or entities where a loan is granted by a private lender to a borrower in exchange for a set interest rate and repayment terms. Private lending is also known as peer-to-peer lending, alternative lending, or marketplace lending. Unlike traditional lending institutions such as…

Read MoreThe Benefits of Securing A Private Mortgage for Your Investment Properties

Irrespective of being a well-established real estate professional or someone who is flipping a property for the first time, securing a loan for a real estate investment is an important step in the process. Both traditional and private lenders offer loans to investors. However, since conventional lenders have strict lending guidelines, it can be a…

Read MorePrivate Mortgage Lending: A Guide for Real Estate Investors

Private mortgage lending can be a useful tool for real estate investors who are looking to finance their projects or to invest in the real estate market. In this guide, we will explore the basics of private mortgage lending, including what it is, how it works, and some tips for investors who are considering using…

Read MoreTop 5 Reasons People Choose a Private Mortgage

There are different types of mortgages for potential homeowners, and each person has to choose the type of mortgage that is going to be best for them. One type of mortgage available to potential homeowners is a private mortgage. It’s not as common as one coming from a big bank, but it’s a valid option…

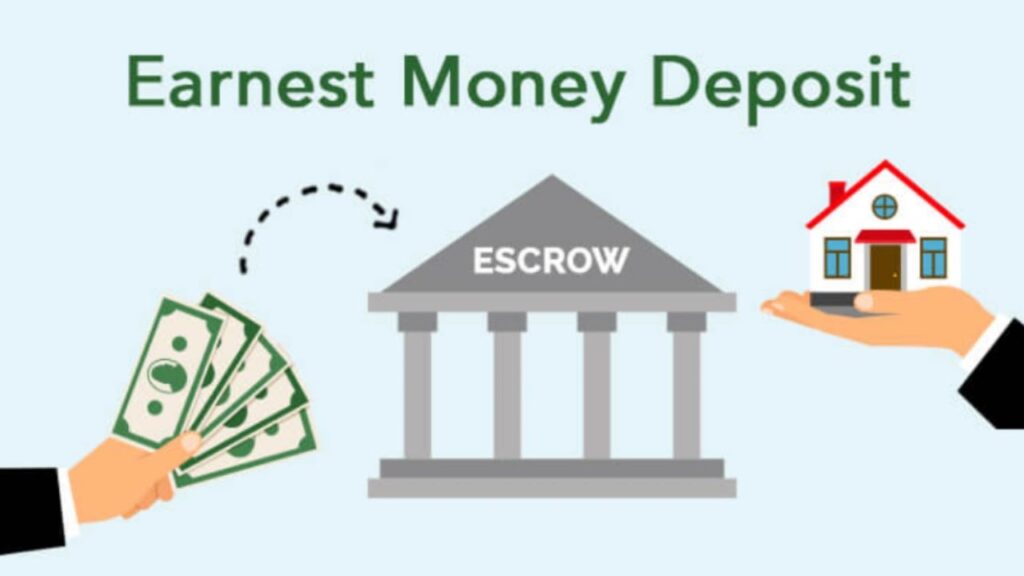

Read MoreWhat Is Earnest Money Deposit

When you find that dream home and want to show your serious intent to buy, you may come across the term, Earnest Money. It is similar to a security deposit that shows you are serious about buying the home. Sure Loan can guide you and explain things to you. Let’s take a closer look at…

Read MoreUnlocking the Potential: Your Guide to Second Mortgages

When you hear the following term, Second Mortgage, you may wonder why anyone would want a second mortgage. There are many reasons to get a second mortgage, and places like Sure Loan are here to answer questions and are here to facilitate the process. Not sure if Second Mortgages are for you? Let’s take a…

Read MoreTips For The Self Employed To Avail Home Equity Loan

When you are self-employed, getting a loan can seem like a struggle. However, it does not have to be though, and you can get a home equity loan whether you are self-employed or not. What is a Home Equity Loan? When you get a home equity loan, you take your home equity to use as…

Read More