Refinance Mortgage

Is Refinancing Your Mortgage Right for You? Here’s What You Need to Consider

If you own a home and have a mortgage, you may have heard about refinancing. Refinancing your mortgage means replacing your current mortgage with a new one, often with different terms, in order to save money, lower your monthly payment, or access your home’s equity. Refinancing can be a smart financial move for right reasons.…

Read MoreHow to Choose the Best Mortgage Refinancing? Option for Your Situation

Refinancing your mortgage is a fantastic option if you are looking to take advantage of the lower interest rates, tap into the equity of your house, or if you want to extend your amortization. At Sure Loan For You, our expert team is qualified to work with borrowers anywhere in Canada to help to identify the…

Read MoreWhen is the best time to refinance your mortgage?

Refinancing your mortgage can help pay off some debts at a lower interest rate or even give you some cash in hand to help you renovate your home. The downside of refinancing means that you are going to be adding to the balance of the mortgage you’re borrowing, which can be daunting – especially with…

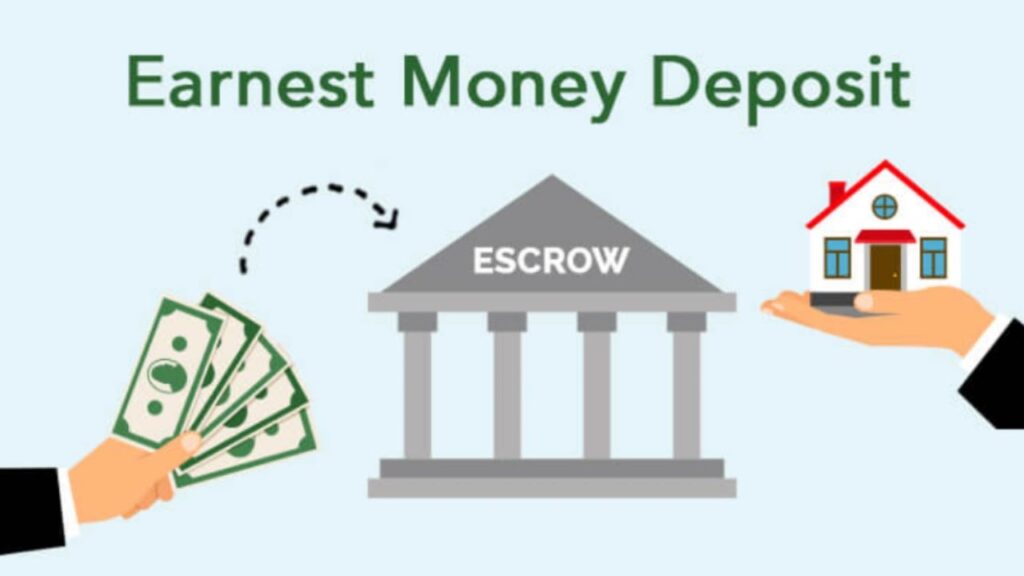

Read MoreWhat Is Earnest Money Deposit

When you find that dream home and want to show your serious intent to buy, you may come across the term, Earnest Money. It is similar to a security deposit that shows you are serious about buying the home. Sure Loan can guide you and explain things to you. Let’s take a closer look at…

Read MoreUnlocking the Potential: Your Guide to Second Mortgages

When you hear the following term, Second Mortgage, you may wonder why anyone would want a second mortgage. There are many reasons to get a second mortgage, and places like Sure Loan are here to answer questions and are here to facilitate the process. Not sure if Second Mortgages are for you? Let’s take a…

Read MoreTips For The Self Employed To Avail Home Equity Loan

When you are self-employed, getting a loan can seem like a struggle. However, it does not have to be though, and you can get a home equity loan whether you are self-employed or not. What is a Home Equity Loan? When you get a home equity loan, you take your home equity to use as…

Read More5 Things To Know Before Renew Your Mortgage

As your mortgage term nears its end, you may be thinking about renewing. You may wish to consider factors such as your income, whether you have been ill or have lost your job and ultimately how these factors can impact your affordability of payments. Here are five points to keep in mind before you begin…

Read MoreTaking A Second Mortgage May Seem Like A Big Chance

Obtaining a second mortgage is a conceptually challenging decision to make. However, in necessary circumstances, it can help solve several financial issues. With a sure loan, you can speak to an agent who will guide you through obtaining a second mortgage. What is a Second Mortgage? A second mortgage is another loan given on an already…

Read MoreEverything You Need To Know About Self-Employed Mortgage

Purchasing a home is a dream that everyone envisions whether they work for a company or are self employed. There are various options available specifically for those who are self-employed. Sure Loan is definitely the place that can guide you on this particular type of loan and advise you further on the loan process. Let…

Read MoreShould I Refinance My Mortgage?

If your current mortgage term is ending, be assured there are many options to help a client regarding their mortgage further. Refinancing is another beneficial opportunity, as it can save you money, build equity, and pay off the mortgage faster. Refinancing a Mortgage Refinancing is when a borrower renegotiates the old mortgage loan contract terms…

Read More