Second Mortgage

How a Second Mortgage Can Help You Achieve Your Financial Goals

Individuals often seek innovative solutions to meet their diverse goals in financial planning and wealth management. One such tool that has gained prominence is the second mortgage. If used smartly, a second mortgage can make a big difference, providing lots of advantages beyond the usual ways of getting money for your home. In this comprehensive…

Read MoreUnderstanding Different Types of Mortgages: A Comprehensive Guide

When buying a home in Canada, securing the right mortgage is crucial in achieving homeownership. Mortgages come in various forms, tailored to suit the diverse needs of Canadian homebuyers. In this comprehensive guide, we will explore the different types of mortgages available in Canada. Shedd light on their unique features, eligibility requirements, and what makes…

Read MoreExploring Your Options: When and How to Consider a Second Mortgage

In the homeownership journey, financial growth and stability opportunities often present themselves. One such opportunity is the concept of a second mortgage – a versatile financial tool that can empower homeowners to achieve various goals. If you have a property and want to know when and how to consider a second mortgage can unlock possibilities.…

Read MoreSecuring Your Future : Leveraging the Equity in Your Home with a Second Mortgage

In today’s uncertain financial landscape, finding ways to secure your future and meet your financial goals is essential. One strategy that homeowners can consider is leveraging the equity in their homes through a second mortgage. A second mortgage allows you to tap into the value of your property and utilize it for various purposes, such…

Read MoreUnderstanding Second Mortgages in Canada

A second mortgage is a type of loan that a homeowner in Canada can take out using their home equity as collateral. In other words, a second mortgage is a loan that is secured by the equity in a property that already has a primary mortgage on it. The amount of a second mortgage is…

Read MoreWhat are the Benefits of Securing a Second Mortgage?

A second mortgage enables the borrower to use the equity in their property as collateral to secure another loan. Below mentioned are the benefits of using a second mortgage: Get approved even with a poor credit score Because a second mortgage is secured against your home, you can borrow even with a bad credit rating.…

Read MoreWhat is the best way to finance a second home?

Buying a second home – whether it’s a vacation home or purchasing one for investment purposes – is going to be a little bit different than when you purchased your primary residence. There are a few ways you can go about financing this purchase, if you need to. One of the ways you can do…

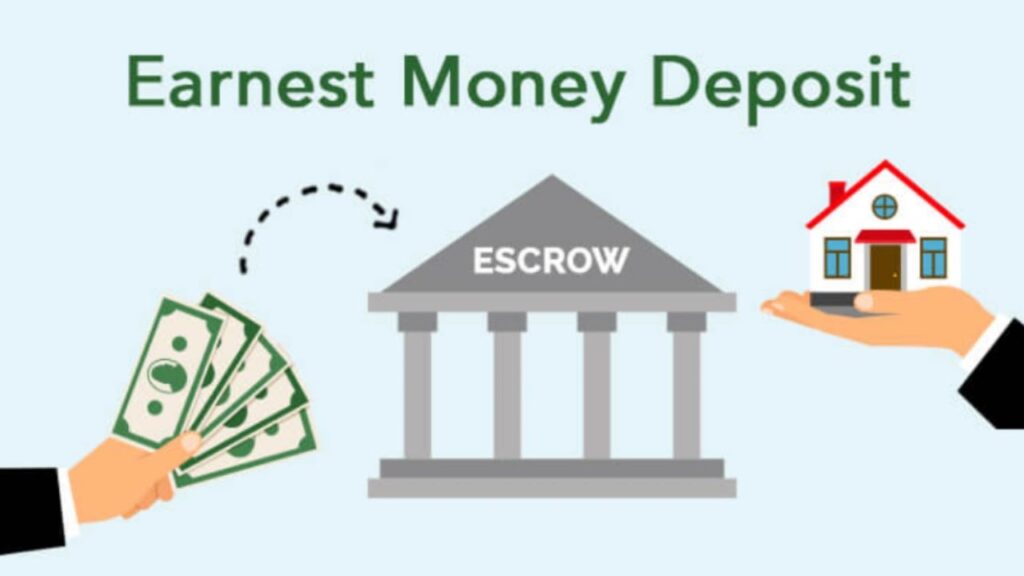

Read MoreWhat Is Earnest Money Deposit

When you find that dream home and want to show your serious intent to buy, you may come across the term, Earnest Money. It is similar to a security deposit that shows you are serious about buying the home. Sure Loan can guide you and explain things to you. Let’s take a closer look at…

Read MoreUnlocking the Potential: Your Guide to Second Mortgages

When you hear the following term, Second Mortgage, you may wonder why anyone would want a second mortgage. There are many reasons to get a second mortgage, and places like Sure Loan are here to answer questions and are here to facilitate the process. Not sure if Second Mortgages are for you? Let’s take a…

Read MoreTips For The Self Employed To Avail Home Equity Loan

When you are self-employed, getting a loan can seem like a struggle. However, it does not have to be though, and you can get a home equity loan whether you are self-employed or not. What is a Home Equity Loan? When you get a home equity loan, you take your home equity to use as…

Read More