Posts Tagged ‘Online Mortgage Service’

5 Refinancing Myths You Shouldn’t Believe

Many homeowners use refinancing as a way to access the equity in their home and get the cash they need to consolidate debt or to finance a larger expenditure. And while refinancing can be an extremely effective tool for doing these things, there are some myths sounding it that homeowners should be aware of. Here…

Read MoreThe Process of Qualifying for Commercial Mortgage Loan

Are you considering purchasing a property for your business? If yes, you will need a commercial mortgage loan. Below mentioned explains in detail the process of qualifying for a commercial mortgage: Evaluating your finances You must know if you will be able to make your scheduled monthly payments. Most lenders will need proof that your…

Read MoreWhat are the Benefits of Securing a Second Mortgage?

A second mortgage enables the borrower to use the equity in their property as collateral to secure another loan. Below mentioned are the benefits of using a second mortgage: Get approved even with a poor credit score Because a second mortgage is secured against your home, you can borrow even with a bad credit rating.…

Read MoreHow You Can Get a Self-Employed Mortgage With a Zero-Dollar Budget

Running a business as a self-employed individual has plenty of challenges, and one of the challenges is getting your mortgage application approved. However, it does not have to be a stressful task. Being a self-employed individual means you have to present more evidence and paperwork, otherwise, your loan will not get approved. Below mentioned are…

Read MoreThe Ultimate Guide to the First Time Home Buyer Mortgage Process

Planning to buy your dream home but not sure where to start? Don’t worry, below mentioned is a step-by-step process to get one step closer to achieving your dream. From finances to paperwork, we’ve got you covered. Step 1: Get your finances in order Like most people, you will need to apply for a mortgage…

Read MoreThe “Now What?” of Being Denied for a Mortgage

You’ve had dreams of buying this home for you, and your family, for years. Whether it’s your first home or you’re upgrading, a new home is very exciting, and it can be devastating when the financing doesn’t work out. If you have been denied for a mortgage, here is what you need to do. Ask…

Read MoreThe Legal Penalties of Breaking a Mortgage Contract in Canada

When you sign a mortgage contract, you are agreeing to make payments for the term of the mortgage (usually 5 years). After the term, you have the option to renew your mortgage for another term or to pay off the balance. If you choose to break your mortgage contract before the end of your term,…

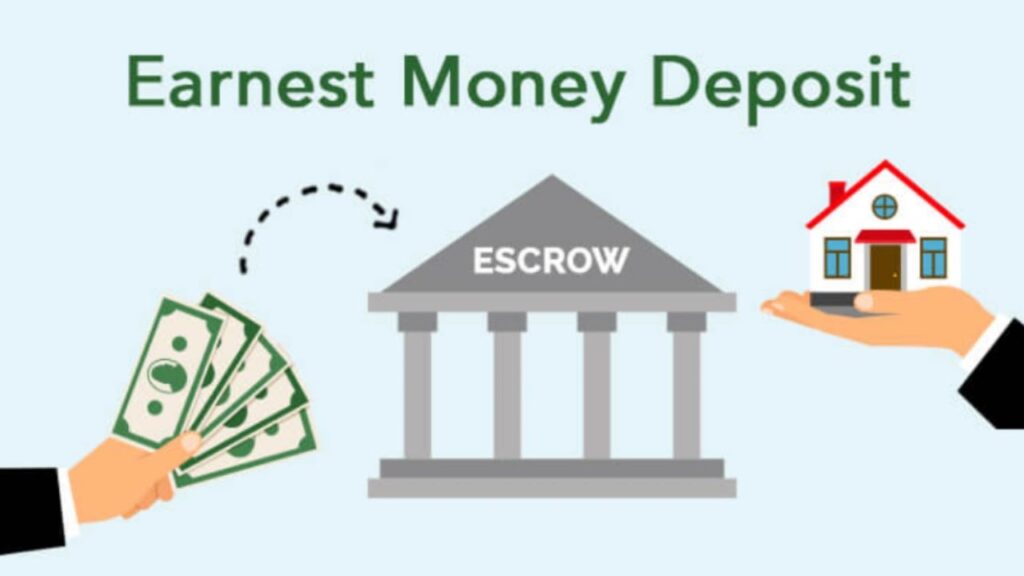

Read MoreWhat Is Earnest Money Deposit

When you find that dream home and want to show your serious intent to buy, you may come across the term, Earnest Money. It is similar to a security deposit that shows you are serious about buying the home. Sure Loan can guide you and explain things to you. Let’s take a closer look at…

Read MoreUnlocking the Potential: Your Guide to Second Mortgages

When you hear the following term, Second Mortgage, you may wonder why anyone would want a second mortgage. There are many reasons to get a second mortgage, and places like Sure Loan are here to answer questions and are here to facilitate the process. Not sure if Second Mortgages are for you? Let’s take a…

Read MoreTips For The Self Employed To Avail Home Equity Loan

When you are self-employed, getting a loan can seem like a struggle. However, it does not have to be though, and you can get a home equity loan whether you are self-employed or not. What is a Home Equity Loan? When you get a home equity loan, you take your home equity to use as…

Read More